My Blog

Take It From Our Experts

Mortgage Rates dropped 0.5% in the last 2 days! It’s like saving $115/mo. & 42k over 30 years without doing anything (other than, lol). Time for a happy dance!

https://www.mortgagenewsdaily.com/.../mortgage-rates...

https://finance.yahoo.com/.../mortgage-rates-fall-below-7...

https://www.mortgagenewsdaily.com/.../mortgage-rates...

https://finance.yahoo.com/.../mortgage-rates-fall-below-7...

A very well put together article by our friend and colleague Julia Israel. The implications in this ruling can indeed be widespread, affecting those who need representation the most. The ruling’s immediate benefit is further transparency to the people we represent, this is good. On the other hand, the long term implications may not be known for years, but Julia eloquently explains how this is hurtful for the public. We all need people that have our backs, it’s a shame when it’s taken away.

(1) How the Sitzer | Burnett decision hurts minority homebuyers | LinkedIn

(1) How the Sitzer | Burnett decision hurts minority homebuyers | LinkedIn

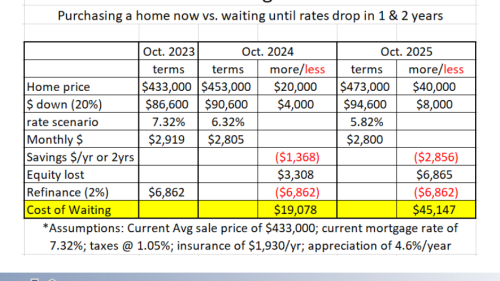

Should you buy now when the rates are in the low 7’s or wait until they drop?

Great question and I put together a table to address buying now vs. 1 and 2 years later.

What you need to ask yourself is if you believe home prices will continue to increase. If the answer is yes, buying now will save you a lot of money as long as you refinance when rates lower. Even this year we had an appreciation of 2.5% while interest rates were 1% higher than after May of 2022. What kind of appreciation do you think we are going to see when interest rates drop?

Take a look at the table I put together. Based on some assumptions (where rates will be) and averages, I believe my numbers are conservative. Waiting until rates drop will cost you $, but everyone needs to make that decision for themselves.

Great question and I put together a table to address buying now vs. 1 and 2 years later.

What you need to ask yourself is if you believe home prices will continue to increase. If the answer is yes, buying now will save you a lot of money as long as you refinance when rates lower. Even this year we had an appreciation of 2.5% while interest rates were 1% higher than after May of 2022. What kind of appreciation do you think we are going to see when interest rates drop?

Take a look at the table I put together. Based on some assumptions (where rates will be) and averages, I believe my numbers are conservative. Waiting until rates drop will cost you $, but everyone needs to make that decision for themselves.

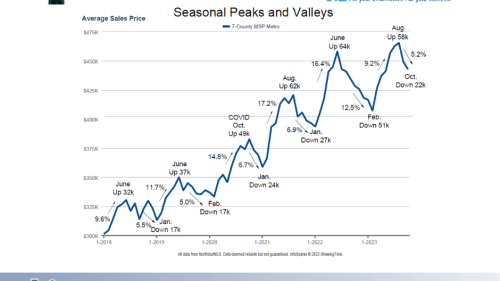

🏠 When would you prefer to buy or sell? 8 years of medians were used in my calcuations with the results stated below. However, no crystal ball here as we can’t predict what will happen in 2024. COVID and interest rates as of late are 2 examples that have affected MN seasonality patterns. Check out the stats and reach out if you have any questions!

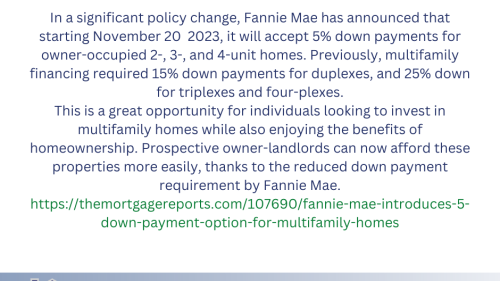

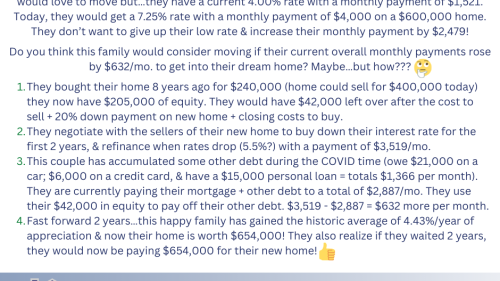

I am taking this question head-on as there is no way to sugar coat the main reason why homeowners are staying put! I am not a not a financial advisor, a lender, or an economist. My numbers are based on researching averages (average debt of Americans currently, etc.) and realistic home prices/rates/scenarios. Creative financing is absolutely paramount and if someone wants to make it happen, you want an awesome realtor and a fantastic lender in your corner to make it happen for you and your family!

🏠%💲Nobody has a crystal ball, but we do our best staying current with the Feds position/inflation/rates and what they are “predicting” has an effect on the market today. Same story, we’ll keep watching as various reports come out and how they respond accordingly. Staying optimistic while the higher interest rates may continue well into 2024, we’ll see! 🤞